Is John Lewis Finance A Reliable Homeowners Insurance Company? John Lewis Home Insurance Reviews

When your home is accidentally destroyed, homeowners insurance protects you financially. To secure a mortgage, you'll need homeowners insurance. Until your loan is paid off, your lender will need you to have homeowners insurance. The terms of your mortgage spell out this need.

John Lewis Home Insurance Background

John Lewis is a partnership, which means that rather than private stockholders, it is owned by its employees. Financial services, such as Home Insurance, Pet Insurance, and Car Insurance, are also available through John Lewis. The Financial Conduct Authority regulates RSA (Royal & Sun Alliance Insurance plc), which underwrites its Home Insurance. Home insurance is available from John Lewis Finance in three different levels: Bronze, Silver, and Gold.

John Lewis Home Insurance Avail Discounts Offered For You

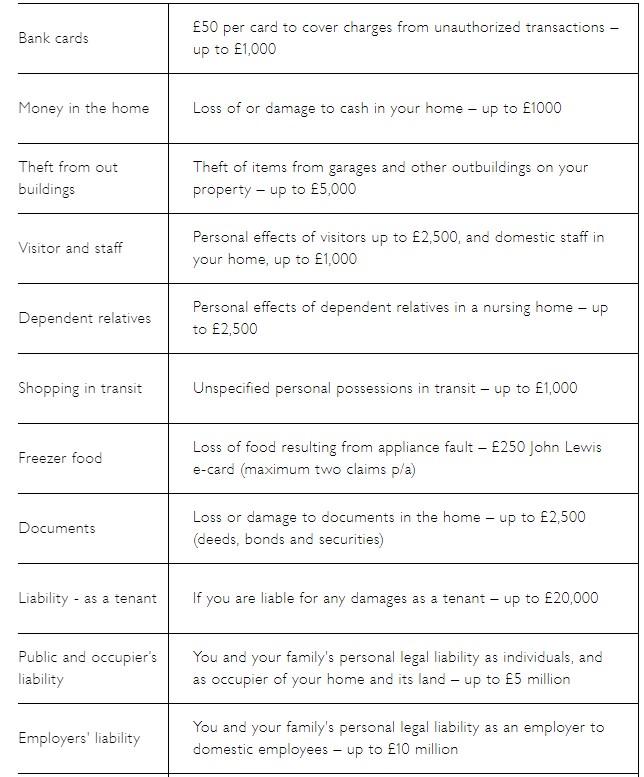

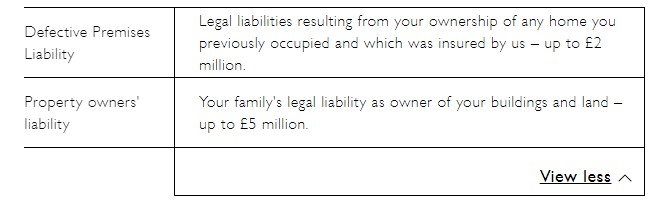

What Are Covered In John Lewis Home Policies?

Table 1: John Lewis Homeowners Insurance - Content Policy

Table 2: John Lewis Homeowners Insurance - Buildings Policy

Compare Buildings And Contents Insurances

Home insurance can be divided into two categories: contents insurance and buildings insurance. Buildings and contents insurance can be purchased individually, but if you need to file a claim, having both types of insurance from the same company makes the process go more smoothly.

Buildings insurance covers the structure as well as any outbuildings like sheds. Buildings insurance protects your home from disasters such as flooding, fire, and subsidence. The contents of your home are covered by contents insurance. Contents insurance protects you from having your goods stolen, and some policies may also cover you if something in your house is accidentally damaged.

John Lewis Gold And Silver Home Insurance Reviewed

As a standard, gold is the most comprehensive. The following are some of the features and advantages offered:

- There are no limits to the number of buildings and content covers you can create.

- There is no limit to the number of different places you can stay.

- Full Accidental Damage Coverage

All benefits (such as garden and cycle cover) are included as standard, whereas these are optional extras with the Silver and Bronze policies. The other significant distinction is that Gold provides unlimited coverage for buildings and contents, whereas Bronze and Silver have claim restrictions.

|

Burst Pipes |

✓Included |

|

Key Cover |

✓Included |

|

Accidental Damage |

Additional cost |

|

Home Emergency |

Additional cost |

|

Personal Possessions |

Additional cost |

|

Boiler Cover |

Additional cost |

|

Legal Protection |

Additional cost |

John Lewis Finance Home Insurance Costs

You can refer to the cost of John Lewis Home insurance membership packages in Tables 1 and 2. It's tough to generalize about the comparative value supplied by different companies because there are so many variables. Comparing quotations, on the other hand, has never been easier, thanks to a number of well-known websites that offer this service.

You need to always keep in your mind that you often get what you pay for. For exceptions, we still find out a service which offers the better quality, a little bit more affordable price and enthusiastic customer services. And, given the high value of homes, characteristics like dependability and customer service may be far more essential than pricing.

Where To Purchase John Lewis Home Insurance?

You can purchase a John Lewis homeowner insurance online and over the phone call. You can refer to the available policies on the website before you decide to buy. Here are some websites selling this insurance: Compare the Market, GoCompare, Confused.com, MoneySuperMarket. Besides John Lewis Insurance, you have many other choices but keep in your mind to consider what is worthy and better.

The FindCouponHere Team hopes that you can get much useful information from this article. It is collected and confirmed by John Lewis Finance company. If you need any more information, don't forget to give us some suggestions. Your ideas and comments are always welcomed! Thank you for reading!

Related articles:

>> John Lewis Finance: Should You Invest In An Insurance For Your Pet Here?

>> Is John Lewis The Best Broadband Provider? Compare Pros And Cons

>> All You Get To Know About John Lewis Gift Card - Check Gift Card Balance