An Ultimate Tax Guide to Track Your Tax Refund on Jackson Hewitt

For almost all citizens in the US, the final step for a tax return is not submitting all of the tax documents, it’s about a long waiting time for the release of the IRS. Where’s my refund? The most frequent questions that everyone wants to know when using tax service from Jackson Hewitt. Here is the detailed guide for tracking your return in tax season and also the common reasons leading to the delay.

How do you track your tax return and refund status on Jackson Hewitt?

Once you complete your filing process on Jackson Hewitt, there are two options that can help you know the status of your refund whether it is approved or in any step of the processing.

MyJH Account of Jackson Hewitt

Anyone who is a customer from Jackson Hewitt can track the latest information of the return through the app of the company named MyJH. It is designed to keep track of the refund process from the IRS. In a simple step, All of the detailed information will be shown on Jackson Hewitt’s friendly user interface. Here is what you need to do for receiving the status of your tax refund from your account.

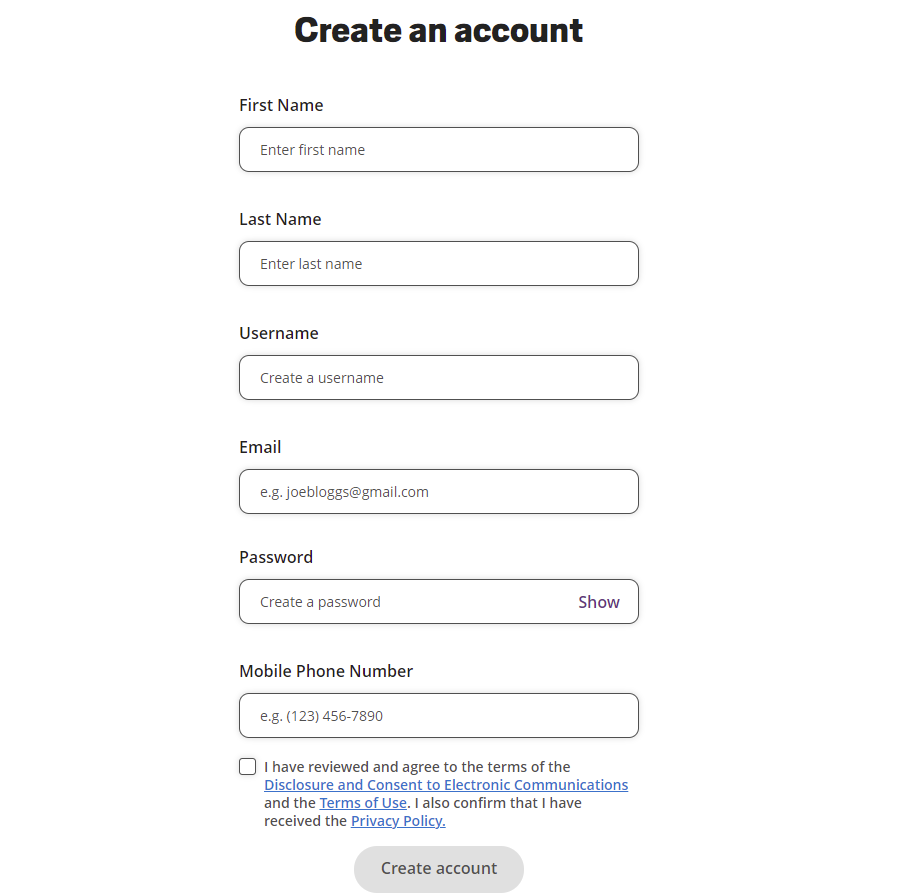

Step 1: Create a MyJH account

Whether you file your tax return on Jackson Hewitt's online app/website, to follow up the processing of the IRS, you will need to have an account under your name. Jackson Hewitt will ask you for some personal information and a phone number for authentication. In this way, MyJH can match your information and their data.

Step 2: Authenticate your created account from Jackson Hewitt

When you complete the registration, there is an extra step to activate your account on the system of Jackson Hewitt. You can authenticate your account through MyJH Dashboard and the official website of the company. If you want to make it done through MyJH Dashboard, you can access Return Status on the dashboard and add the necessary data that MyJH asks for.

If you prefer the Jackson Hewitt website display, you can browse JacksonHewitt.com and then click on "Verify Account" on the navigation of the MyJH Account area. You will need to finish Express Authentication or Standard Authentication to start your tracking. For Express Authentication, a 16-digit code - Document Access Code on tax documents obtained from your Tax Pro will be given in order to authenticate your account.

Step 3: Track your refund status on Jackson Hewitt app/ website

A valid account from MyJH enables you to follow your tax documents from this year and the prior year. Right after you file your tax return from Jackson Hewitt, your form will be submitted to the IRS and wait for acceptance.

The waiting time can last for a day or two days based on your filing option e-filing or mailed paper returns and your data whether there is an error or not. When your file is approved, the IRS will process your tax refund within roughly 2 days of acceptance.

Within 19 days to 21 days of the processing, your refund will be deposited by IRS. The latest information on your refund will be represented on your MyJH account. If you have not received your deposit as expected, you can ask for support from IRS.

Jackson Hewitt Discounts Recommended For You:

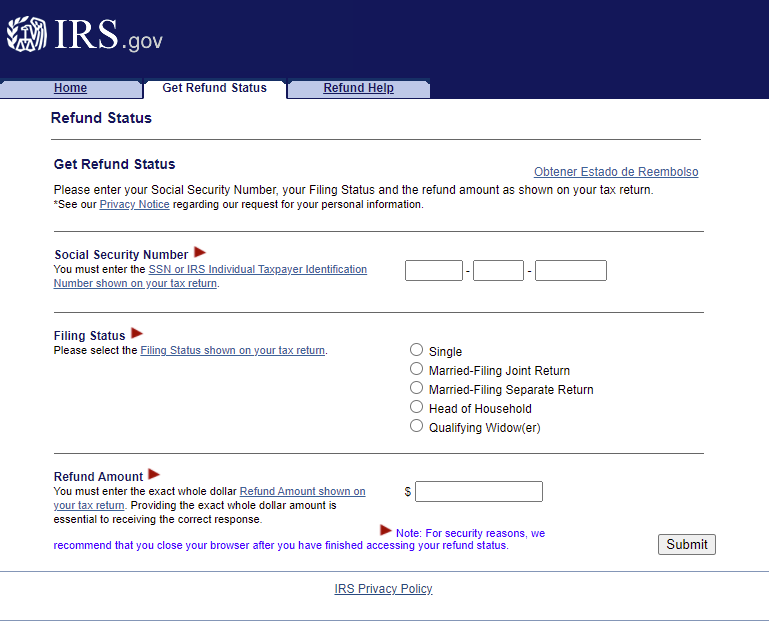

IRS’s Where’s My Refund Tool

Another solution for keeping track of the status of your tax refund is through the updated tool from the IRS. They provide detailed information on the company’s platform: IRS official website, app IRS2Go and IRS refund hotline. No matter the methods you choose, you can easily track the refunding process of the IRS.

If you have any problem or want to have information about your tax refund, you can call 800-829-1954. It is extremely helpful for people who want to contact directly the IRS or can not access the Internet.

What documents should you have to track your tax return on Jackson Hewitt?

Because you have filled in your MyJH account with the basic information so there is no need for you to prepare for any extra tax documents. The automatic tool of Jackson Hewitt allows you to add the data to your refund form and also see the process of the IRS after 24 hours of e-filing. It is more advanced for the mail method which needs four waiting weeks to start tracking your needed information.

Tracking information on the Jackson Hewitt app/website is the most simple and convenient way for you. In some steps, all of the data will be displayed on your phone screen or computer. It is in contrast with tracking on the IRS platform. You are required to show your Social Security number or ITIN - Individual Taxpayer Identification Number, your type of tax refunds such as single filer or head of household, and the amount of refund.

When do you expect your Jackson Hewitt tax refund?

In general, you will receive your tax refund within 21 days from the filing day. For example, those who submit their claims before the end of January will get a direct refund of taxes on the first week of February. Due to external or internal reasons, your refund can be delayed for some days but it doesn’t mean that you will not receive your benefits. The IRS will not inform you of the exact deposit time but you can follow up through your account on the Jackson Hewitt website/ app.

Can you receive your Jackson Hewitt tax refund 2 days early?

According to the policy of the IRS, no one can access the tax refund before the releasing day. There is a schedule for each person to receive their deduction. Therefore, the sooner you file your tax return, the faster you receive your money back. In the case that you need your refund immediately, you can apply for the Refund Advance tax loans program from Jackson Hewitt. They will give you the refund in advance without an interest rate

>>Recommend for you:

- Everything about Jackson Hewitt Holiday Loan You should know

- Reviews That You Must Listen Before Enrolling Jackson Hewitt Tax Classes (Updated for 2021)

- How Much Does Jackson Hewitt Service Cost?

Waiting for the refund is always a long process that requires patience. Although we receive the email notification from the IRS and Jackson Hewitt about a schedule of the tax refund, updating the refund processing will let us expect when the refund will be deposited to our account and have a plan for this amount. Hope that our guide is helpful. If you like our article, don't forget to follow up and subscribe your email to receive latest information.